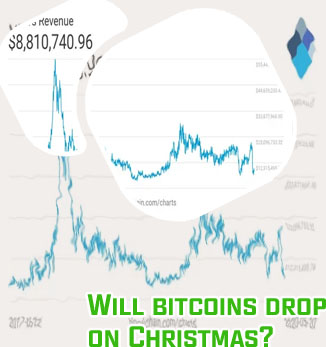

A big bet on Bitcoin mining

On Tuesday, ARK Invest CEO Cathie Wood weighed in BlackRock's bitcoin ETF application while HSBC Bank launched its own bitcoin, ethereum offerings. The world's largest cryptocurrency leapt to its highest level in over a year last week after major investment firms sought regulatory approval for BTC exchange traded funds. Why is bitcoin falling right now MicroStrategy has acquired an additional 12,333 BTC for ~$347.0 million at an average price of $28,136 per #bitcoin. As of 6/27/23 @MicroStrategy hodls 152,333 $BTC acquired for ~$4.52 billion at an average price of $29,668 per bitcoin. $MSTR https://t.co/joHo1gEnR0

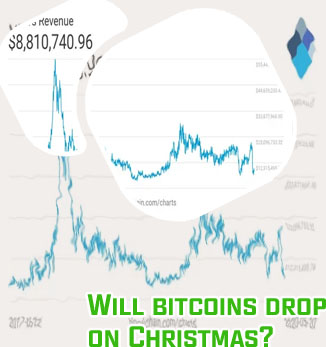

When is bitcoin expected to drop

Investopedia / Hugo Lin No tangible, fundamental value The yo yo gave in to gravity again at the beginning of 2022, fueled largely by the political unrest and protests in Kazakhstan and the subsequent internet shutdown. What did the situation in Kazakhstan have to do with the Bitcoin? Since China's crackdown on the currency, its neighbor has risen to become the second biggest player in the Bitcoin mining landscape, accounting for 18.1 percent of all global computing power used for the activity.

An Investment You Can Easily Buy Low

Bitcoin. "Frequently Asked Questions," Select "Transactions: Why do I have to wait for confirmation?" Bitcoin prices over time: Recently, big players like BlackRock, WisdomTree, Invesco, etc, and some others have filed for a Bitcoin Spot ETF. Besides, a crypto exchange is also expected to be launched by Cidatel in conjunction with Fidelity and Schwab. The adoption rate is expected to rise with the rise in the BTC price

When will bitcoin go down

Unlike everyone else on this list, Digital Coin Price is bullish on the Bitcoin Cash price. Their analysis sees the coin to more than double in value in one year, and keep rising well into the future. Their forecasted Bitcoin Cash price for 2030 reaches $1,000. Note: MicroStrategy is a software company that converts its cash into Bitcoin and heavily invests in cryptocurrency. Former CEO and Board Chairman Michael Saylor claims MSTR stock is essentially a Bitcoin spot ETF. That hike — the Fed raised interest rates three-quarters of a percentage point on Wednesday, the highest single jump in 28 years — has left a strong impact on crypto, given how many of the sector’s investors rely on loans. “Borrowing has been very important for anyone participating in the crypto market,” Xu wrote.